Table of Content

The flexible loan terms are available for up to 60 months. We’ve all heard stories about people getting under a huge amount of debt and not being able to recover from it after unexpected circumstances kept happening one after another. Many people have second thoughts when the word ‘loan’ comes up in the conversation – sure, adding up to your monthly dues can be a scary thing. The Social Security System Housing Loan, was built to provide working Filipinos with low-cost housing, home loan assumption, and home improvements.

SSS housing loans may have many benefits but are not as commonly used as other housing loans. An SSS housing loan can be used to buy a lot on which to build a new home. It can also be used to buy an existing residential property such as a house and lot, condominium, or townhouse.

Interest rates on loans in the Philippines

Borrower and spouse are updated in the payment of their other SSS loan if any. The age of the member is not more than 60 years old at the time of application. With employment contracts that are awaiting renewal/deployment, however, the release of loan shall be made upon renewal/employment.

Members who wish to apply for a Salary Loan must fill out an application form and submit it to the nearest SSS branch office. The property subject of the loan must be occupied by the owner-borrower or his/her immediate family member upon purchase of the unit. The Social Security System Housing Loan was established to provide low-cost housing, home loan assumption, and house repair to working Filipinos. The Social Security System, a state-run social insurance program, issues an SSS Housing Loan. While SSS Housing Loans are not as prevalent as Pag-IBIG Housing Loans, they do have a number of advantages.

Q: What are the advantages of buying a house first?

An interest rate is a rate that is charged for the use of money. Interest rates are displayed on an annual basis, known as the annual percentage rate . If your loan application is rejected, you are legally entitled to a free copy of your credit report.

It’s crucial to be aware of the distinctions to obtain the best conditions even when taking on a lot of debt, in addition to being successful in our applications for the financing we require. The loan can be renewed after payment of at least fifty percent (50%) of the original loan amount and at least fifty percent (50%) of the loan term has lapsed. If the loan is not fully paid at the end of the term, interest shall continue to be charged, as well as penalties, on the outstanding principal balance until fully paid. Here are the 3 easy steps to check your SSS loan balance online at the official website of SSS.

What do you require to opt for an SSS Salary Loan? How Do You Pay it back?

The process is almost the same as when viewing your contribution online. This is hassle-free since it will only take you less than 5 minutes to accomplish plus you do not need to leave your home. The Philippine Government started giving out SSS Salary loan to working employees who are in need of money for the short term. This loan is given to working people only as it ensures that they will return the money back soon.

Also, did you know that once you’ve been granted a loan and have paid it off completely, the next time you apply for one, you will be given a higher loan limit? It’s just like how it is with credit cards – but you get the cash on top of the convenience. You can easily repay your loan payments through various means, such as online banking, cash, cheque, or ATM transfers. PSBank’s Prime Rebate is a unique feature that allows its customers to earn rebates when they make their monthly payments. If you don't pay the whole amount by the due date, you'll be charged a penalty of 1% per month until the loan is repaid in full.

The online application process only takes a few minutes to complete. Once all the required information has been submitted, approval will be given within five to seven working days. Various loan amounts.Depending on your credit rating and the amount of money that you can borrow, you can borrow up to PHP1,000,000. Project-Based Financing – This feature allows the DBP/LBP/SSS funded clients to lock-in the terms and interest rates of their loan. New car loans are available for up to 60 months, while used car loans are available for up to 48 months.

Buying a house is one of the biggest purchases you’ll ever make. To help you make the best housing loan decision, we've compiled a short guide to explain what you need to know before you apply for a mortgage. Bills such as internet connection and electric and water bill are oftentimes included in the background checking procedure of bank loan applications, which is why you mustn’t miss your bills’ due date. Two problems are probably to blame if your lender rejects your loan application on the basis of your income. The first is that your income is below what the lender considers to be minimal.

To obtain an SSS loan, there are certain conditions put forward by the authorities, such as – the borrower must not have committed fraud in the Social security System. Moreover, he or she has to provide certain documents like Passport ID, marriage contract, birth certificate, Postal Id and more. All the documents submitted shall be original or true certified copies.

You also must not have any previous Pag-IBIG loans that were foreclosed on, cancelled, or bought back due to default. You can get approved for your Pag-IBIG housing loan in as little as 16 working days, if you submit all of the necessary paperwork. This means the length of time or period in “months” or "number of years" wherein you can repay your housing loan.

The social security system's business development loan facility is a lending program to assist businesses. It can help businesses with financing for expansion, diversification, and other business development projects to boost productivity and potential earnings. OFWs involved in the community are eligible for this housing loan. In reality, among OFWs, SSS housing loans are well-known. The amount for a one-month loan is equal to the average of the borrower's recent 12 month salary credit, or MSCs, or the amount requested, whichever is lesser. Similarly, if they apply for a two-month salary loan, it will be twice their monthly average, or MSCs, or the actual amount requested, whichever is lesser.

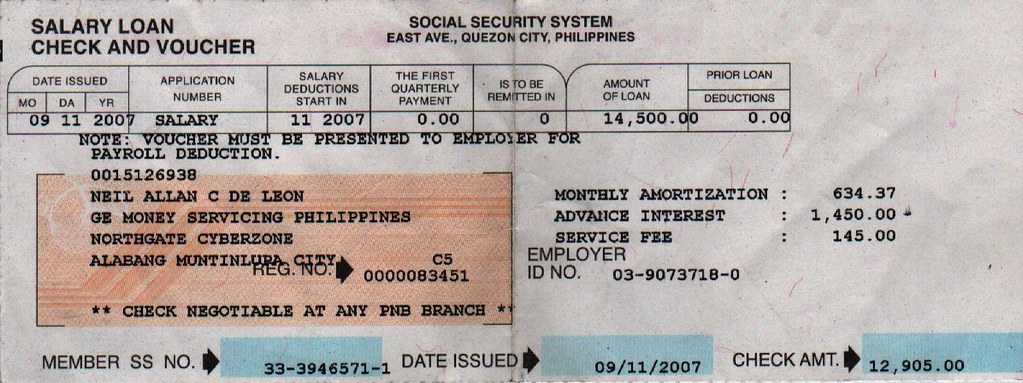

Regardless of whether your property is in Manila or outside, the inspection fee is ₱500. The margin of financing is also known as the loan-to-value ratio. Banks in the Philippines base the amount that a client can borrow on the age and income bracket of the applicant, property type and location and the current value of the property on the market. The typical margin of finance given to borrowers is 80%. The Salary Loan is a short-term loan made available to SSS members who are currently employed and paying their monthly contributions.

Latest two months’ pay slip is duly certified by the employer. Receive the Letter of Guaranty and Notice of Approval . When the Pag-IBIG officer finds your application complete and in order, you will receive the LOG and NOA, which you will claim in the Pag-IBIG branch where you submitted your application. Submit the required documents to the designated Pag-IBIG business center or branch. A long-term overseas Filipino resident who wants to take advantage of housing packages for their extended family, for themselves, when they retire, or when they visit the Philippines.

No comments:

Post a Comment